Australia’s Ongoing Property Crash Speculation

The past two years have seen much speculation around the potential for a property crash in Australia. With record prices, high clearance rates and low interest rates, commentary about the potential bust of a property bubble has been sparking debate and varying opinions amongst key commentators and the media. The best way to understand the property market and if there is a property crash looming is to study the framework of the economy and understand the national (stock) market.

Predictions galore

Macquarie released a statement in October 2015 declaring the Australian housing market had peaked, stating “our economics team are forecasting quarter-on-quarter house prices to fall from the March 2016 quarter before beginning to recover from June 2017, with a 7.5 percent fall from peak to trough.”

Shortly after this, Westpac increased their interest rates independently of the Reserve Bank igniting conversation that big change was upon us, potentially for the worse. Furthermore, this move resurfaced an age old debate between the stock market and property market, with Credit Suisse commenting “Australian property is now riskier than the stock market.”

These occurrences seemed strange given that in August 2015, the ASX saw a significant low after ongoing concerns about China and their international performance. Furthermore, stocks affected by Australia’s housing sector continued to move higher throughout this period.

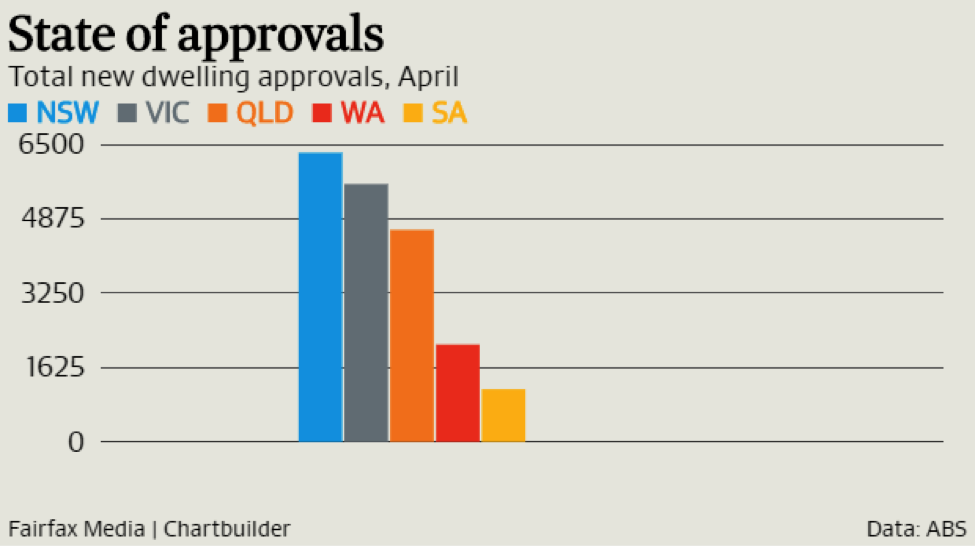

Interestingly, despite these worrying signs, an increase in the construction of new homes tells a different story. According to the ABS new housing approvals rose in April to the highest monthly level in the six months prior. A total of 20,243 new homes have been given the tick of approval by planning authorities from October 2015 to April this year.

Source: AFR, May 2016, http://www.afr.com/real-estate/residential/housing-approvals-rise-to-sixmonth-high-buoyed-by-8pc-rise-in-apartments-20160531-gp7up0

Australian brick supplier Brickworks Ltd announced an astonishing record performance for the first half of the year, with profits up 19.4 percent. Similarly, concrete supplier Adelaide Brighton Ltd also posted record revenue up 20.4 percent to $207 million. They declared an ongoing struggle to supply enough concrete to the east coast housing market. What this tells us is there is a high volume of construction materials required to keep up with the increasing demand for new housing.

The true property market update

To get a real understanding of the property market, let’s look at the facts. Although Macquarie and Credit Suisse’s predictions, along with others, may not have come to fruition, there is truth behind the fact the property market is changing, but it seemingly isn’t as dire as some commentators have suggested.

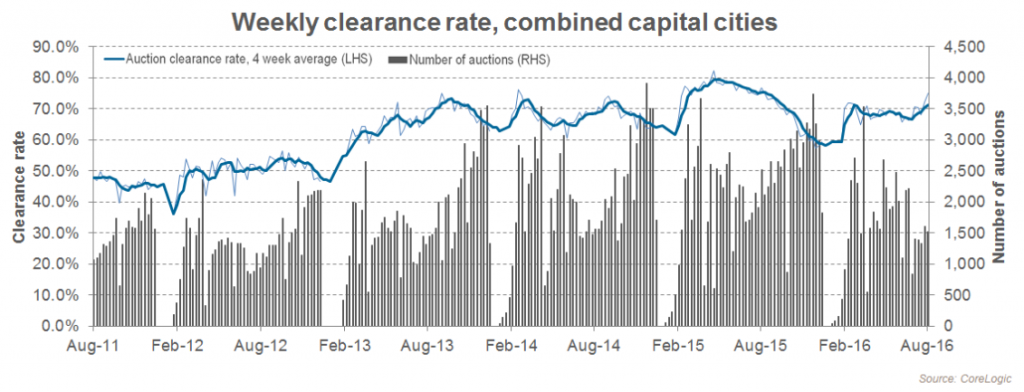

The graph below shows that this year’s auction market has significantly decreased compared to the same period last year – down to 12,469 from 15,142 auctions according the CoreLogic RP Data. CoreLogic research director, Tim Lawless, remains confident that the boom is winding down. “I still think we will see the rate of growth slowing down because of affordability constraints,” he said.

Source: CoreLogic, 2016, http://blog.corelogic.com.au/2016/08/less-auctions-across-capitals-clearance-rate-reaches-year-date-high/

Australia’s employment rate remains strong, and interest rates are at a record low. Combine this with Australia’s GDP continuing to beat forecasts, it’s easy to understand why there’s more on the horizon than the dire straits predicted.

A true indicator of a property crash would be evident in homeowners and investors selling their assets cheaply and quickly, but we’re yet to see any signs of distressed selling across the nation. If employment continues its strong performance, it’s unlikely distressed selling will occur as so long as people are employed they can continue to afford their mortgages.

While it’s important to stay informed and educated about market performance, it’s equally as important to be diligent about where you are sourcing such information. Do your research, look at the facts and consult a professional.

If you have any questions about your property, or are looking to expand your portfolio, contact CPS Finance today.