Speculating vs investing?

There are many ways to make money from property. How you go about it will depend on whether you are a speculator or an investor.

The difference is usually in the timing.

I’m not talking about timing of the market where you buy at the bottom and sell at the top, (as if you can ever accurately pick those times anyway). No, I’m talking about you and the time you are right to move from investing to speculating.

You see, there is a significant difference between investing and speculating and to understand what I mean by that I think it’s instructive to look at the definition of each one.

According to Investopedia.com

“Speculation is the act of trading in an asset or conducting a short term financial transaction that has a significant risk of losing most or all of the initial outlay with the expectation of a substantial gain.”

While investing is defined as;

“Investing is the act of committing money or capital to a long term endeavour such as real estate with the expectation of obtaining an additional income or profit.”

One method has high risk attached to it and the other is a measured, long term approach to making money. Each method can make you money, no question about it. Looking at it another way we can say that your risk level will decide which way you will invest.

Searching for big profits quickly falls into the speculative camp while investing for the long term falls into the investor category. Again, both types can make money but the risk of losing it goes up with the level of speculation involved.

At CPS Property we want all of our clients to be better off after they have seen us. For most people this means that they are either new to investing or need more education in the fundamentals of property investing.

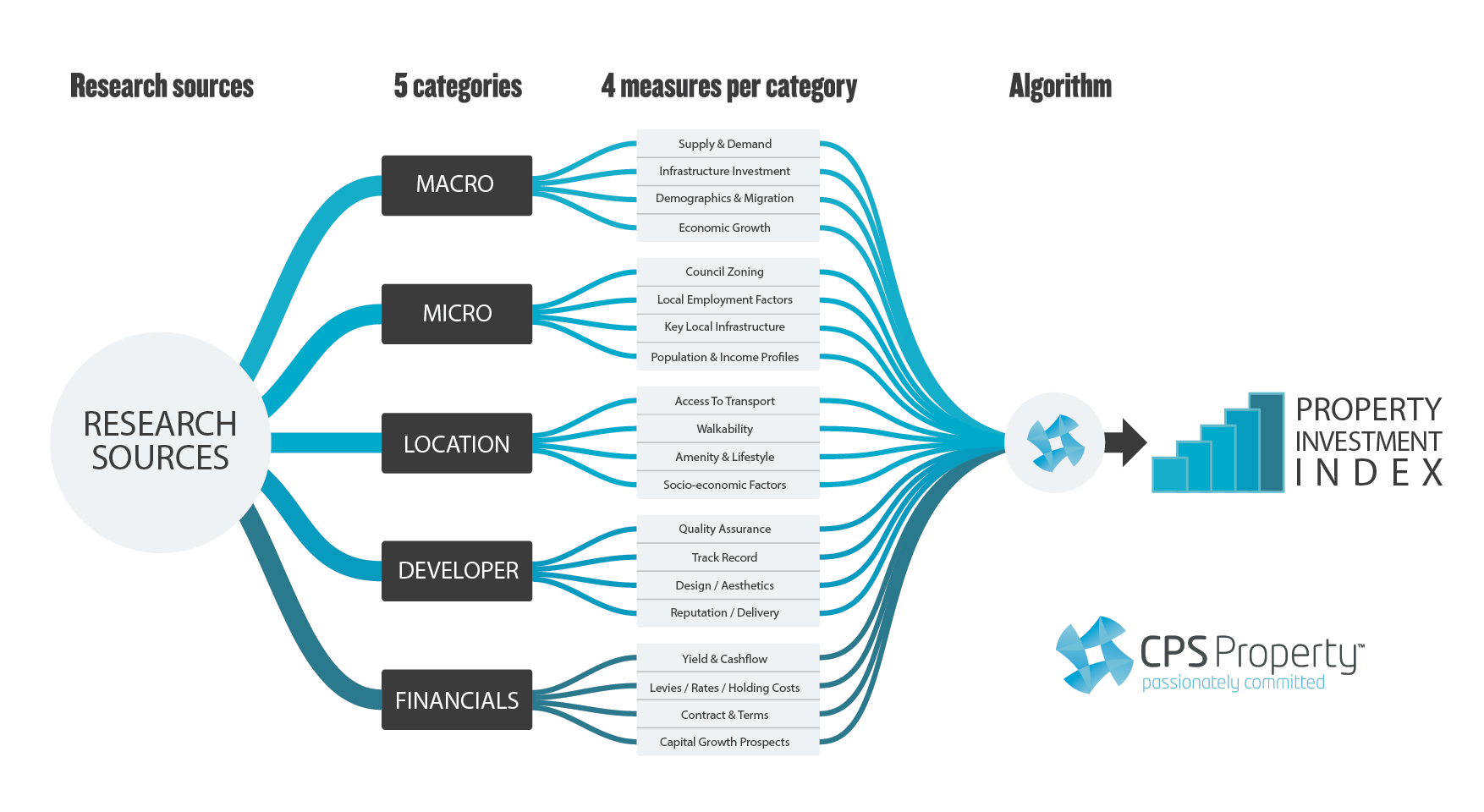

To fulfil this need we created our CPS Methodology and Asset allocation which is used to identify potential growth suburbs and to select the right property at the right price in the right location.

A long term investor will work their way towards a property portfolio using the same basic fundamentals each time. This type of methodology provides consistent results over the long term and is symptomatic of a systematic approach to successful investing.

By applying the key criteria we identified suburbs that our competitors weren’t recommending which made us pioneers if you like. Not everybody agreed with our selections but the interpretation of the data was very clear.

Even today, I still remember a potential client handing back a contract for a 1 bedroom Studio in Surry Hills priced at $420k because they thought there wouldn’t be any growth in that area after the GFC – I should mention that the same property is now selling in Surry Hills is $750K, just on 5 years later.

Naturally, we have identified other suburbs with similar results so we have no problem applying the CPS Methodology to locate new opportunities.

It’s worth pointing out that the CPS methodology cannot be used to identify opportunities for speculators. It utilizes data that can be interpreted for long term investment, reducing the risk to our clients. It’s a serious long term solution to investing in property.

Another difference between the two investor types is an Investor can benefit from the advice of a Financial Planner. Long term low risk investments fit nicely into a Financial Plan. After all, a Financial Plan is looking to get the result you are looking for, over a given time frame, and in line with your risk profile. It would be difficult, to say the least, to design a Plan that incorporates high risk, short term investments and still be confident of success.

The fundamentals we apply for our clients are designed to provide an acceptable level of risk in conjunction with an achievable Plan using a property that fits our methodology.

We also like to educate investors on how they can improve by reviewing their current property portfolio and borrowing position. Listening to the noise in the media and avoiding educating yourself is a sure way to create confusion.

Given that this is the message we have been preaching since 2005 there is little reason to change a successful formula.

Jacob O’Neill

Principal.