Why investors are turning to dual occupancy properties

Investors are increasingly looking to dual occupancy properties to capitalise in an environment where prices continue to rise. This property style allows for economies of scale during the building process and requires that you only purchase one block of land to acquire two income streams.

What is a dual occupancy property?

A dual occupancy property offers two incomes to an investor by way of two separate living spaces and therefore two tenancy opportunities. Common examples of a dual occupancy property include a granny flat, duplex or dual-key property. Although these property types all have the potential for rental income, there are various differences between them which will affect investors.

Different types of dual occupancy properties

- Granny flats: typically the size of a studio or one bedroom apartment and located to the rear of an existing, larger property. Generally speaking, a granny flat will require council approval before building the property, as well as being allowed to accept tenants into the property.

- Duplex: two properties which are adjoined or share common walls, such as a house divided into two separate properties, and can therefore be sold separately.

- Dual occupancy: not too dissimilar to duplexes, dual occupancy properties share common land but do not have to be adjoining or share common walls.

- Dual-key property: typically one property with a shared front entrance door and hallway and potentially additional living spaces such as the kitchen and living room. However there is a section within the property which is locked and rented out to a separate tenant, for instance a bedroom and ensuite.

The benefits of dual occupancy properties

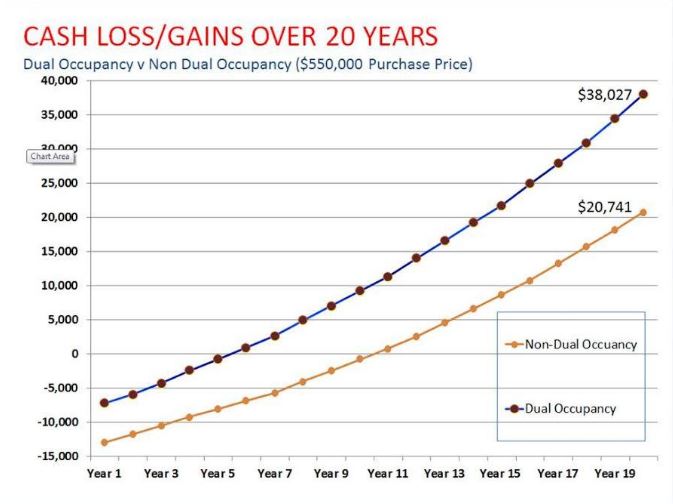

There are several benefits of dual occupancy investment properties. The main factor being the ability to maximise the potential of one block of land. Essentially this means improved cash flow and reduced maintenance costs. Furthermore, they are a smart decision for investors looking to grow and diversify their property portfolio.

Source: build, 2016: http://www.build.com.au/blog/5487

A dual occupancy property delivers a superior cash flow and therefore allows an investor the opportunity to pay off their mortgage at a faster pace.

To discuss your dual-occupancy investment options, contact CPS Finance today.