How to make untapped equity work for you

Equity is the difference between what you own and what you owe on a property. For instance, if your property is worth $1 million and you owe $300,000, then you have equity of $700,000. As investors or property owners make their way through their mortgage repayments, the advantages of equity are often forgotten. Smart investors should capitalise off their lazy equity to maximise their portfolio’s worth. Here’s what you need to know about getting your property to work in your favour.

Savvy investors should look to recycle their equity as quickly as possible. Once the property experiences growth, a valuation should be prepared by your bank in order to determine your overall equity. This process can be repeated as often as annually.

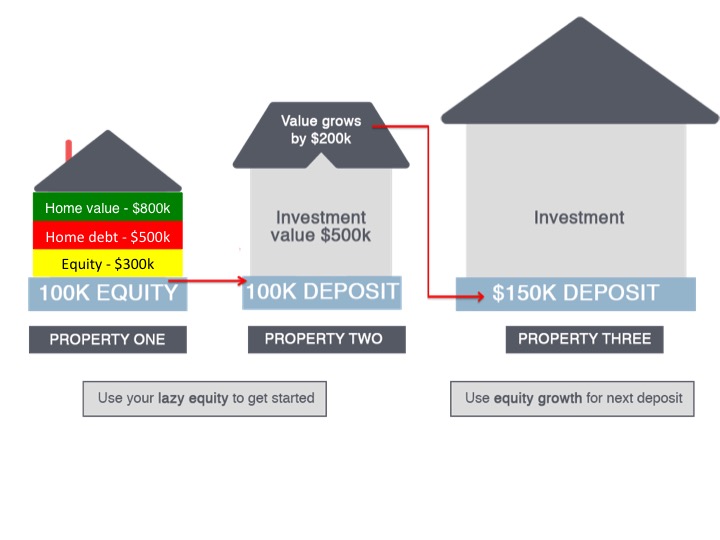

How to use your lazy equity

Below is a simple visual representation of how you can turn your equity into something substantial. The key is to duplicate this process in order to build a larger, more sophisticated property portfolio.

Source: Property Buyer, 2016, http://www.propertybuyer.com.au/

How much do properties grow in value?

This is never an easy question to answer. The below figures detailing Sydney’s median house prices over the past four decades go some of the way to answering this question.

1980 – $68,800

1990 – $194,000

2000 – $287,000

2009 – $547,000

2016 – $1,050,000

There’s a clear pattern in how properties have grown each decade, with the most recent median prices growing exponentially.

With the right advice and financial structure, you can use your lazy equity to continuously grow your portfolio.

What now?

If you’re keen to grow your portfolio, follow these steps:

- Revalue your property: first things first, make sure you get your property valued. It will give you true transparency on what your financial situation is before you make any decisions.

- Recycle your equity: do this after making considered, educated decisions. Ensure you seek the help of professionals to assist with your choices. A mortgage broker and financial advisor are a great place to start.

- Get the equity moving: engage with property professionals to seek out a great investment purchase which is capable of providing you with high capital growth and strong rental yield.

To get your equity to work for you, contact CPS Property today to discuss your investment options.