Why property owners should use an offset account

When investing in property there are various different loan types that you can come across including fixed term loans, variable-rate loans as well as being able to use an offset account. An offset account has the potential to save you thousands or even hundreds of thousands of dollars during your mortgage lifetime. So what exactly is it and how can you use it? Alex Goldhagen from iBuyNew explains.

What is an offset account?

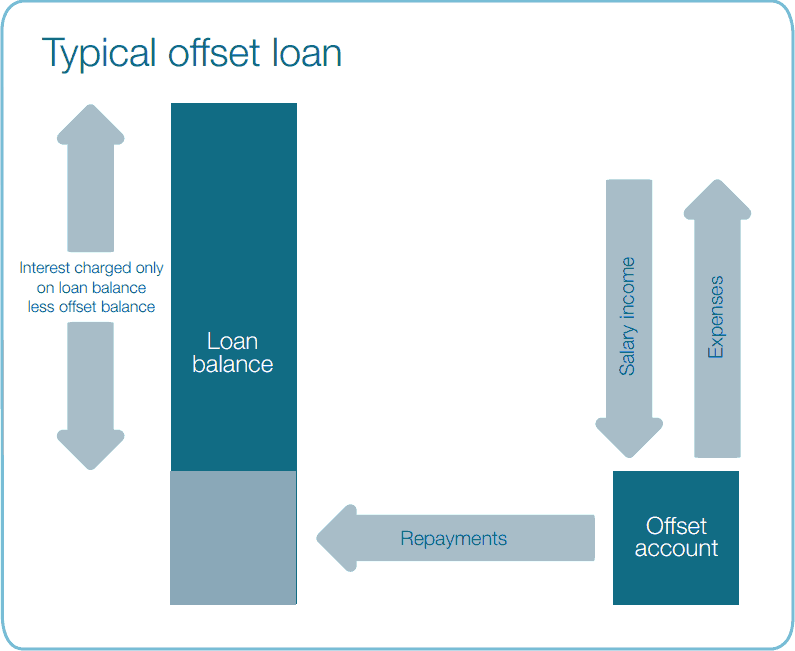

An offset account is a type of transaction account that can be linked to your home or investment loan to save you money on interest. It is used to reduce the interest you owe on your mortgage by offsetting the credit balance of your transaction account daily against your outstanding loan balance.

How an offset account works

A customer takes out a $500,000 mortgage at 5% interest per annum over 30 years. They decide to put $50,000 in an offset account. As $50,000 is now in this account, the interest is now calculated on $450,000, rather than $500,000. This customer will therefore save $142,211 and will also reduce the loan term by 4 years and 3 months.

It is great for savers as any extra cash you have left over from your wage each month can be put into this account to help reduce your interest even further. You could even put the rent you receive from tenants into this account.

Benefit of an offset account

One major benefit of having an offset account is that it allows you to pay down your mortgage faster so you end up paying less interest in the long run, which is especially ideal on an owner occupied home. It also acts as a transactional account enabling you to deposit as well as withdraw money allowing you to have access to your savings if you require them. This can allow you to move quickly on the purchase of another property if the right deal comes along.

Disadvantages of an offset account

As well as benefits, there are also some disadvantages which you should bear in mind before proceeding. These include:

- It might have an account-keeping fee attached to it.

- It might have higher interest rates or fees compared to a basic home loan.

- A partial offset account only offsets a percentage of the balance whilst a 100% offset account will offset the full amount, but is usually only available for variable-rate loans.

Should you have an offset account?

So should a property investor use an offset account? Deciding on whether to have this type of account or not will ultimately depend on your situation. If you know you are a good saver and have a large sum of money that you can put aside then this option could be right for you. By leaving your money untouched for longer this will help lower your home loan repayments each month and the overall interest you will have to pay.

Before proceeding with an offset account it is important to seek expert independent advice first to know exactly what you can and cannot do. You should also shop around to find the best option to suit you.

Want to find out whether an offset account will work for you? Talk to CPS Finance to discuss your options.